Order Volume and Delivery Delay Trends as of March 2020

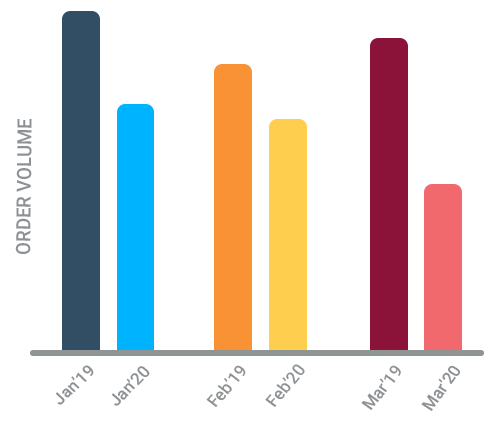

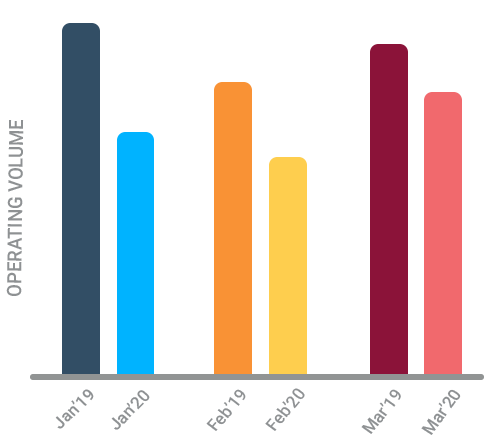

Apparel & Accessories

In the Apparel & Accessories category, we see a significant dip in the order volume during March, 2020 when compared to March, 2019. We see that overall order volume dropped nearly 60% during the month of March 2019. With consumers staying indoors, this reflects the pandemic having the most impact on this category when compared all retail verticals.

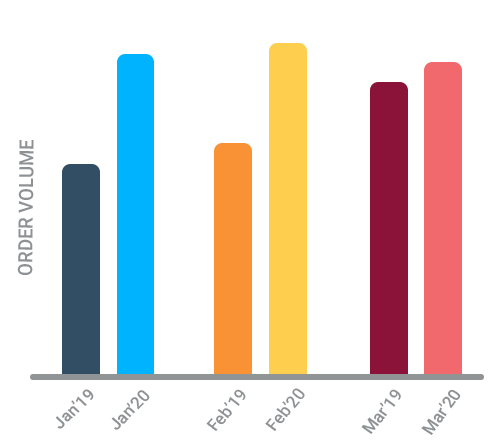

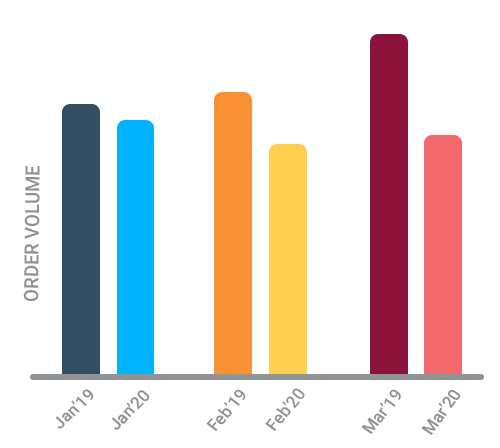

Consumer Electronics

The Consumer Electronics vertical continued to have a strong run with their sales. The order volumes during the month of March, 2020 did not see much of change when compared to March, 2019. With businesses and individuals taking to remote working and spending time at home, work and leisure gadgets remain necessary to get through the lockdown.

Food & Beverages

As an essential category, we observed the Food & Beverages segment take only a slight hit in their online order volumes during the month of March, 2020. With consumers switching to online purchasing for safer buying, this new normal will see a permanent positive impact on food retail.

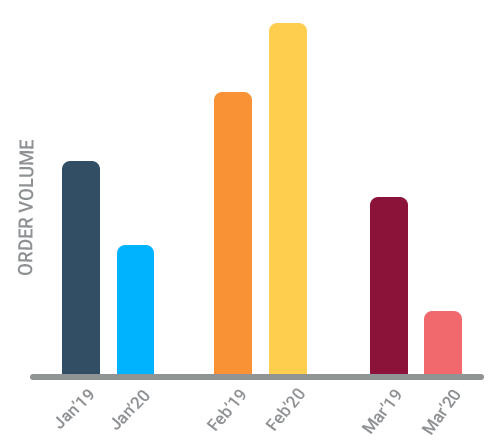

Home & Toys

The Home & Toys segment saw a significant drop in their order volume during the month of March, 2020. With over 50% drop in sales, home improvement businesses along with the toys industry will continue to see their sales soften in the next few weeks.

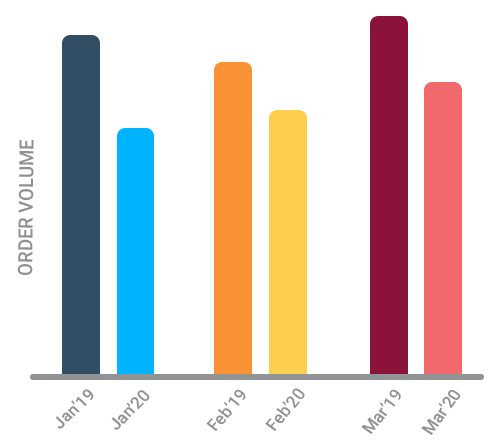

Auto Parts & Tools

The Auto Parts & Tools segment saw about 15% drop in their order volume during the month of March, 2020. When compared to the months of January, February and March in 2019, there has been a drop in sales during 2020.

Health & Fitness

In the Health & Fitness category we see their order volumes to have dropped by 25%. In the coming months, we could see a surge in demand for goods from this category as buyers opt to workout at home and follow healthier lifestyles.

Delivery Delay Trends across Major Shipping Carriers as of March 2020

The supply chain will remain a top concern for retailers during the COVID-19 crisis. All major shipping companies have warned about service disruptions due to the pandemic. The delivery delay rates we’re observing for eCommerce shippers using FedEx, UPS and DHL are as follows.

FEDEX

UPS

DHL

About the data

The “order volume” and “delivery delay” insights here are drawn from statistically relevant data processed from millions of parcels tracked by LateShipment.com for leading eCommerce retailers in the U.S. who ship via FedEx, UPS and DHL. Trends and insights drawn are on the basis of observations made on LateShipment.com’s real-time tracking solution – Delivery Experience Management Platform. For comparative analysis, parcel data from January – March 2019 is compared with parcel data recorded during January – March 2020.

Useful resources for you

COVID-19: Service Updates from FedEx, UPS, USPS, DHL, & Canada Post

With people choosing to stay indoors, practicing social distancing, isolation or quarantining, there is likely to be a spike in online shopping…

Delivery Experience Management (DEM): Retail’s New Weapon To Drive Customer Experience

Low prices, fast shipping, and free returns are three must-haves for an online business to make the cut in today’s market…

Use Cases for LateShipment.com’s Delivery Management Platform

The last mile can be a minefield for eCommerce retail businesses. There is an air of inevitability about the whole phase…