Close to 3 billion people shop online across the world. Do all of them keep what they order? Definitely not. In fact, the return rate for ecommerce shopping is estimated around 20-30%. The reasons can range from fit or quality issues to customers simply changing their minds.

At such times, e-commerce businesses are placed in a tough spot, with only two choices: to either issue a refund hassle-free and salvage the customer experience (losing revenue in the process), or deny the refund and say goodbye to that customer, and hello to negative reviews that will severely impact future sales.

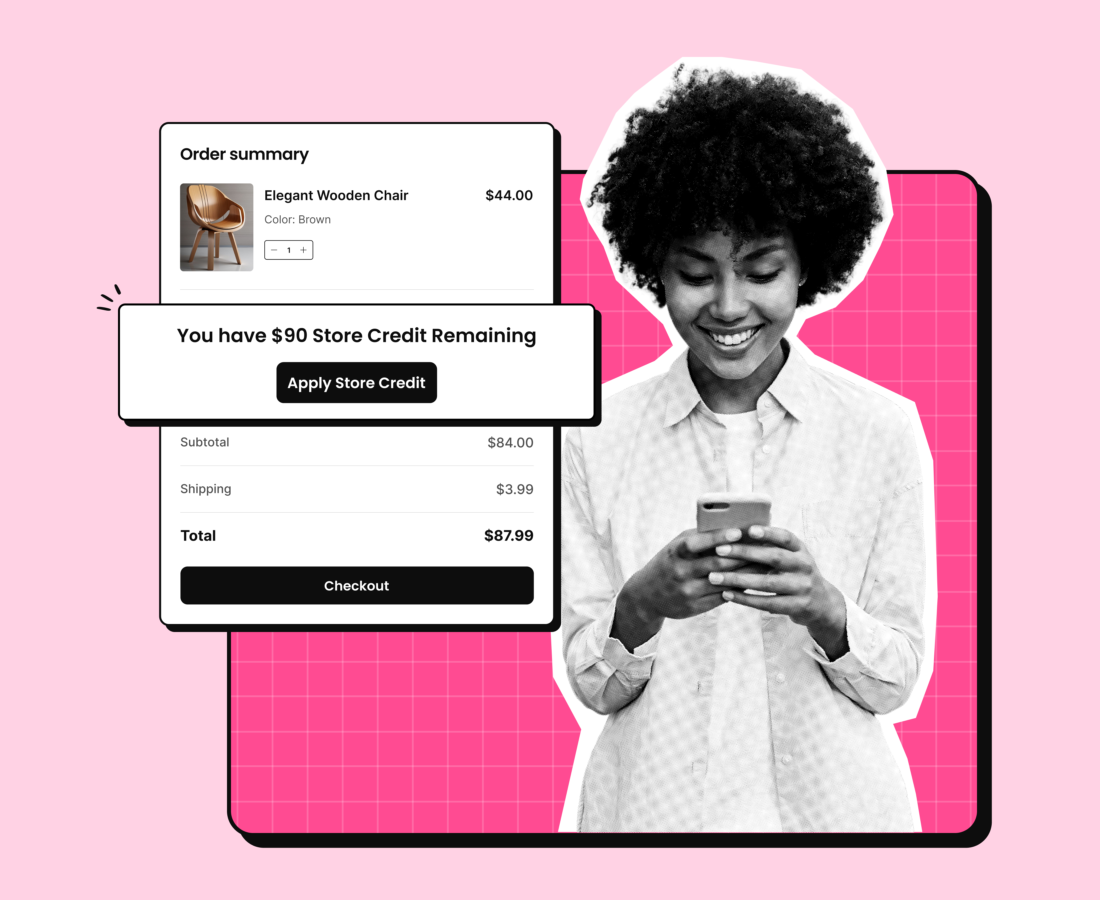

Caught between a rock and a hard place, it can be difficult to see a way out. But we’re here to light the way with a big neon sign—Store Credit!

Store credit offers you the perfect escape from this common e-commerce business predicament. And if you’re wondering what this is, and how you can start leveraging it, keep reading, because you’re in for a treat.

What is Store Credit?

Store credit is like a second chance at shopping—except instead of cash, customers get a digital handshake from the store saying, ‘Come back, we got you.’ It’s a value issued by retailers that customers can use for future purchases instead of receiving a refund.

Unlike cash refunds, where there’s a possibility that the customer might exit your business forever, store credit keeps customers engaged, encouraging them to explore more products. Whether as compensation for a return or a reward for customer loyalty, store credit benefits both customers and e-commerce businesses. It comes in many forms—which we’ll be discussing next.

When used strategically, it not only retains customers but also boosts revenue. Think of it as a gentle nudge to keep customers coming back for more.

Types of Store Credit

You can consider offering store credit to your customers in a variety of packaging. Here’s a look at the eight types of store credit you should consider integrating into your store policy:

Exchanges

Exchanges and returns are common forms of store credit that keep revenue within your business while maintaining customer satisfaction. Instead of issuing refunds, offering store credit for returns encourages shoppers to make another purchase, reducing revenue loss.

Exchanges streamline the process by allowing customers to swap items without disrupting sales. Both options enhance customer retention while minimizing the financial impact of returns on your eCommerce business.

Gift Cards

Gift cards offer convenience and flexibility for both e-commerce businesses and customers. They allow customers to prepay for products or services, providing a seamless way to manage returns or exchanges.

For online stores, gift cards are a good way to retain revenue, encourage repeat purchases, and even attract new customers, all while offering a simple, straightforward solution to store credit.

Store Credit Cards

Store credit cards are a popular type of store credit, allowing customers to make purchases on credit specific to a retailer. These cards often come with certain perks like discounts, rewards, or exclusive offers, encouraging repeat business.

For e-commerce businesses, offering store credit cards can boost customer loyalty and increase sales.

Loyalty Rewards

Loyalty rewards incentivize repeat purchases by offering points, and discounts based on spending. They make customers feel valued while encouraging customer engagement with your e-commerce business.

Loyalty rewards and store credits go hand in hand to boost customer retention. By offering store credit as a reward for repeat purchases, referrals, or special milestones, businesses incentivize customers to keep shopping. A tiered system, where spending more unlocks higher credits, encourages larger purchases while reinforcing brand loyalty, enhancing customer satisfaction, and driving long-term engagement.

Registration Credit

Registration credits are a type of store credit that can incentivize customers to register and engage with your store. Offering credits for signing up turns casual visitors into registered shoppers, increasing the chances of converting them into repeat customers.

These credits encourage users to create accounts, providing you with the opportunity to send personalized offers and promotions. To maximize impact, consider promoting order credits through pop-ups or announcement bars, enticing first-time visitors to sign up and earn rewards.

Order Credits

This type of store credit is issued to customers after they complete a purchase. These credits serve as a means to increase repeat business by rewarding shoppers for their loyalty. Customers are more likely to return to your store when they know they have credits waiting for their next purchase.

Additionally, you can offer bonus credits for multiple orders, further incentivizing frequent shoppers and enhancing customer retention.

Referral Credit

By offering credit for successful referrals, e-commerce brands encourage word-of-mouth marketing while keeping funds within the store. This strategy not only boosts customer acquisition but also increases repeat purchases, as both the referrer and the new customer are incentivized to shop again, creating a cycle of loyalty and sustained revenue.

Birthday Credits

Birthday credits are a powerful way to boost customer engagement and loyalty. By offering store credit on a customer’s birthday, you create a personalized purchasing experience that encourages repeat purchases.

This small yet thoughtful gesture enhances brand affinity and increases the likelihood of additional spending beyond the credit amount.

Why is Store Credit Better Than a Refund?

Store credit is often used as an alternative to refunds by e-commerce businesses. Here’s why:

- Drives Repeat Business: Store credit encourages customers to spend their money with the same e-commerce business instead of going elsewhere. This incentive to return to the store helps drive the e-commerce business’s repeat purchases and by extension revenue.

- Helps Retain Customers: Store credit also helps build customer trust as it communicates how much the e-commerce store values the customer’s business (regardless of whether the store credit is offered instead of a refund, or as part of a reward program).

- Reduces Refund Rates: By offering store credit as an alternative to refund, e-commerce businesses reduce their refund rates drastically.

In short, tweaking your refund policy to offer store credit instead of cash has several benefits for e-commerce businesses.

Advantages and Disadvantages of Store Credit

Store credit offers significant benefits to e-commerce businesses, but can come with its share of shortcomings as well. Here’s a look at the merits and demerits of integrating store credit into your store policy:

Drives Customer Loyalty and Retention

Store credit can be understood as a friendly bribe—in the best way possible. When you offer customers store credit instead of a refund, they gain a solid reason to return, browse, and hopefully buy again.

It is a subtle yet effective way to boost retention while enhancing their brand experience. More importantly, it gives businesses another shot at impressing customers, turning a return into a second chance. Over time, this repeated engagement builds loyalty, making customers more likely to choose your e-commerce business over competitors. Store credit isn’t just money—it’s a relationship builder.

Incentivizes Customers to Spend More

Store credit can also do the job of sitting on your customer’s shoulder and whispering ‘Why not check that out too?’, the angel, not the devil. Customers feel more comfortable purchasing when they know they can return products if they don’t like them rather than having to find space for them later.

But here’s where the magic happens—once they land back on your online store, they rarely stop at just using their credit. Think about it, if you go back to the grocery store because you forgot to buy apples, do you just return with apples, or is there something else in the bag too?

So for your customer—that stylish jacket? Those extra accessories? They’re spending more than intended. Smart e-commerce businesses recognize this and use store credit to turn simple returns into bigger sales. It’s psychology but with a shopping cart!

Prevents Loss of Revenue on Returned Products

Returns can be a nightmare for e-commerce businesses—products come back, revenue disappears, and everyone’s left a little frustrated. But store credit flips this. Instead of issuing refunds that drain revenue, businesses can offer credit, keeping sales within their ecosystem.

Customers still get value, and retailers don’t lose out completely—it’s a win-win. Further, it encourages customers to browse again, often leading them to spend even more. So rather than watching money walk out the door, store credit keeps the cash flow alive while maintaining a positive customer experience.

Offer a Flexible Return Policy

67% of customers check an e-commerce business’s returns page before making a purchase. Consider expanding your return policy to offer online store credit for returns, giving more flexibility and options to your customers, without losing their business.

Implementing this strategy means offering a comfortable return window, and fewer return restrictions

Store credit can be a double-edged sword. While it keeps revenue within the business, it can also leave customers feeling boxed in—like getting a gift card to a store they didn’t pick. Restrictions such as expiration dates or product exclusions can add to their frustration, potentially leading to poor reviews and lost future sales.

On the operational side, managing store credit isn’t exactly cost-free. It requires system updates, customer service intervention, and extra accounting work. Further, when customers use store credit, businesses still have to handle new orders, shipping, and fulfillment. And if those purchases get returned? Welcome to the endless loop of logistics, where costs quietly pile up. Striking the right balance between protecting revenue and maintaining a customer-friendly return policy is key to keeping both sides happy.

E-commerce businesses can navigate the challenges of store credit by making it as customer-friendly as possible. Offering flexible terms—like longer expiration periods and fewer restrictions—can improve customer satisfaction and loyalty. Clear communication about store credit policies upfront helps manage expectations and reduce frustration.

On the operational side, investing in automated systems for tracking store credit can streamline accounting and logistics. Additionally, offering incentives, such as bonus credit for store returns, can turn a potentially negative experience into a win-win, keeping customers happy while ensuring revenue stays within the business.

How to use Store Credits to Retain Customers

Here’s a look at some strategies for leveraging online store credits efficiently:

Offer Personalized Store Credit

Personalization is key today—there are no two ways about it. McKinsey reports that 71% of customers expect personalization from businesses and 76% get frustrated when they don’t find it. You might have heard of personalization in marketing initiatives, we’re here to tell you that you need to implement it when offering store credit as well.

You can do this by tailoring your store credit offers to match your customer’s behavior. You could, for instance, offer store credit on bags, if your customer’s purchase history indicates they like your collection of bags.

Reward Loyalty with Tiered Store Credit

Encourage repeat purchases and strengthen customer loyalty by offering store credit based on spending milestones. Reward customers when they reach a specific purchase value, place a certain number of orders, or celebrate their first purchase anniversary.

Implementing a graduated rewards system, where store credit increases as customers spend more, further incentivizes higher spending. For example, a $5 store credit for $100 spent can increase to $10 for $200 spent. This approach not only boosts revenue but also makes customers feel valued, enhancing their overall shopping experience.

Provide Store Credit in Exchange for Reviews

The impact of social proof cannot be discounted today.97% of customers say online reviews aid them in their purchase decisions. What’s more, positive reviews can make customers spend 31% more money as well.

To improve your online reviews, consider offering store credit to encourage customers to share testimonials, ratings and reviews on your offerings. This doesn’t just get your quality reviews but also incentivizes customers to continue shopping with your store with the store credit.

Offer Limited Time Offers to Incentivize Purchases

Consider adding limitations to your store credit. You can make them more appealing and encourage customers to use store credit fast by adding time limitations to them. For instance, you can offer a bonus credit if your store credit gets used within a specific time frame.

This helps quicken the return of customers to your e-commerce business as well as prompts more frequent purchases.

Encourage Referrals

Did you know that a whopping 77% of customers are more likely to purchase a new product when their friend or family member suggests it? Knowing someone has tried and liked something will naturally make us less skeptical about purchasing it ourselves.

So why not use store credit to supercharge your referrals? Consider offering store credit to your customers in exchange for promoting your business. You can ask them to share a unique referral code with their friends and family. And when the latter purchases with that referral code, not only do they get a discount on their first purchase, but your customer whose referral code has been used also gets store credit.

This strategy can help you drive your customer acquisition efforts as well as help retain existing customers.

How to offer Store Credits

Offering store credit isn’t a tough nut to crack. All you have to do is integrate it into your current return policy. Managing and tracking store credit can be done manually. However, it won’t be the most efficient.

For modern e-commerce businesses working hard to scale their operations, a returns experience management software like the one offered by LateShipment.com is essential. Our robust solution helps you reduce your return-related support tickets by 80%, and returns processing time by 95% while helping you retain up to 40% of revenue through exchanges, and you guessed it—store credit! Here’s how:

- Branded Returns and Exchange Portal: Help customers initiate return requests through a branded return portal within your storefront.

- Downloadable Shipping Labels: Generate downloadable labels and offer detailed shipping instructions right from your branded portal.

- Offer Refund as Store Credit: Retain your revenue by offering store credit instead of refunds.

- Offer Bonus and Incentives: Encourage store credit and exchange over refunds by offering customers free shipping and compelling discounts.

- Customizable Return Rules: Break down complex return policies into easy-to-understand automated rules.

- Return Insights: Gain detailed data on returns, from frequency and most returned products to internal operations and cost of returns.

- Seamless Integrations: LateShipment.com’s solution connects seamlessly with over 1200 carriers and tools to ensure your entire tech stack is always on the same page.

Curious as to whether LateShipment.com is a good fit for you? Check it out today!

Conclusion

Store credit is a powerful tool for businesses, offering a win-win scenario—customers get value, and e-commerce businesses retain revenue. From exchanges and gift cards to loyalty rewards, store credit encourages repeat purchases and enhances customer retention. However, while it can boost sales and prevent refund losses, it also comes with challenges like administrative overhead and potential customer dissatisfaction if not managed well.

To make store credit a seamless and effective part of your business, consider LateShipment.com’s Returns Experience Management software. This solution simplifies returns and exchanges with self-service options and automation, ensuring customers enjoy a hassle-free experience. By turning returns into opportunities for engagement rather than friction points, businesses can foster loyalty and maximize retention.

Store credit doesn’t have to be a headache—it can be a strategic advantage with the right tools in place.

Ready to upgrade your returns experience? Book a demo today!