We’ve all been there: eagerly awaiting an online order, only to receive a damaged product or, worse, nothing at all. It’s a huge letdown for the customer and a potential loss for you. Sure, you can offer a refund, but that comes out of your pocket, even if the shipping carrier was at fault. And no one likes being punished for someone else’s mistake!

Now, this need not always be the case. Shipping insurance can give you much-needed protection from such mishaps and help you recover at least some of the losses associated with a damaged or lost package.

Let’s find out how exactly shipping insurance works, why and when you need shipping protection, the various types, and the right way to choose the shipping insurance that aligns with your needs.

What is Shipping Insurance?

Shipping insurance is essentially a safeguard for your packages in transit. It offers much-needed protection against several potential problems, including loss, damage, theft, and even late delivery in some cases. This type of insurance helps you recover the financial losses associated with these shipping mishaps, whether the issue is caused by carrier error, mishandling, or unforeseen circumstances like natural disasters.

With shipping insurance in place, you can offer refunds or replacements for lost or damaged goods without impacting your bottom line. This protects your revenue, helps maintain customer satisfaction, and builds trust in your brand.

Learn More: What is Shipping Protection?

Types of Shipping Insurance

There are four predominant types of shipping insurance: carrier-provided insurance, third-party shipping insurance, all-risk insurance, and international shipping insurance. You can choose the right one based on the items you ship and your requirements.

1. Carrier-Provided Insurance

Most carriers (like FedEx, UPS, and USPS) offer some level of declared value coverage. This means you declare the value of your shipment, and if it’s lost or damaged, the carrier will reimburse you up to that stated amount.

However, this is not applicable in all situations. The coverage amount might be capped, and certain items might be excluded. With carrier insurance, always make sure to read the fine print.

2. Third-Party Shipping Insurance

Third-party insurance providers specialize in shipping protection and often offer more comprehensive coverage than carriers. They might cover a broader range of items, provide higher coverage limits, and have a more streamlined claims process. These providers can be great for businesses that regularly ship valuable or fragile goods.

3. All-Risk Insurance

As the name suggests, all-risk insurance offers the broadest coverage. It protects your shipments against virtually any cause of loss or damage, except for specific exclusions listed in the policy (like acts of God or inherent vice). This type of insurance is ideal for high-value shipments where you want maximum protection and minimal losses.

4. International Shipping Insurance

International shipping insurance, as the name suggests, is a type of insurance that protects goods that are shipped from one country to another. It covers losses or damages that may occur during transit, whether by sea, air, or land.

Benefits of Shipping Insurance

Shipping insurance can save you from significant financial losses. Here’s why if you need to consider it:

1. It offers protection against loss and damage

We’ll start with the most basic reason — insurance protects your shipments against common errors such as loss and damage.

A well-known fact is that shipping is a complex process, and packages can be lost or damaged during transit. Statistics say 11-15% of packages get lost or damaged in the U.S. annually. Your customers’ packages can end up being one of them, too.

With proper protection in the form of insurance, losses and damages will only be considered isolated shipping incidents instead of having the potential to cause any actual harm to your business.

2. It is easy to get yet an invaluable asset for your business

Since insurance is added per package, it is actually as easy as paying an additional fee to your shipping costs and can be done with minimal to low paperwork. Despite being easy to get, shipping insurance must not be considered trivial, as it has multiple pros for your business.

With insurance, your business has a backup against damages and losses they bring. On the customer front, compensating them when faced with issues helps in restoring both lost customer satisfaction and brand reputation.

3. It offers steady peace of mind

In your business’s daily operations, the last thing you want to worry about is the potential for significant loss due to damage or shortage.

Investing in shipping insurance based on your thorough understanding of carrier and third-party options, as well as the importance of documentation, will help you get the most out of your insurance plan, giving you peace of mind in your shipping procedures.

4. It offers a sense of financial security

The cost of a lost or damaged shipment can be really high, especially for high-value items or fragile products.

$500K is the estimated loss for e-commerce businesses from lost and damaged packages in a year. (Source: National Retail Federation)

Worry not! Shipping insurance provides financial security by covering the declared value of the shipment, preventing your business from bearing the full cost.

With shipping insurance providing financial protection, you can practically ensure that your business doesn’t suffer financial losses when such incidents occur.

5. It eliminates unforeseen risks

Now, let’s talk about what shipping insurance actually stands for.

No matter how equipped your businesses are, unexpected events such as theft, natural calamities, or accidents in the post-purchase phase can potentially hurt your business.

By insuring your packages, you can make sure that your business doesn’t suffer huge financial losses due to circumstances that are not in your control. This way, you are fully prepared, even against threats you don’t see coming.

In short, with guaranteed protection that insurance for shipping offers from financial losses and reputational damage, it is an investment that keeps your business protected.

While shipping insurance offers several benefits, the truth is that you may not always actually need it. Let’s find out when you need shipping insurance.

When Do You Need Shipping Insurance?

Shipping insurance is a worthy investment based on the products, quantities, or conditions you’re shipping:

1. High-Value Items

When shipping goods such as electronics, jewellery, artwork, or any luxury items, it is worth investing in shipping insurance. These big-ticket items can lead to huge financial losses to your business when damaged or lost.

2. Fragile Goods

Despite packaging and efficient handling, there is still a possibility of fragile products breaking during transit. If you’re a shipper of goods like glassware, ceramics, or instruments, you should be insured to cover the potential losses on that front.

3. Bulk Shipments

Shipping goods in bulk can be cost-effective, but the cumulative cost of the entire goods is substantial enough that they shouldn’t be left uninsured. When dealing with large amounts of parcels in transit, ensure they are insured.

4. Peak Shipping Seasons

During the holidays or special seasons, the volume of shipped goods increases dramatically due to heightened consumer purchases.

With numerous goods in transit during these seasons, shipments experience various challenges, like carrier strains that lead to damage or loss. Using shipping insurance is necessary at this phase to avoid huge losses.

How to Choose the Right Shipping Insurance

Now, let’s see how you can choose the right insurance for your business. Here are some factors to consider.

1. Understand Your Shipping Risks

Shipping insurance is never unnecessary. However, there may be cases where the cumulative cost of insurance might be higher than the occasional loss you experience as a business.

In such cases, before choosing a shipping insurance provider, you must evaluate your business’s specific risks. For instance, if you’re shipping electronics, luxury goods, or fragile items, you are at a higher risk for damage and loss and, therefore, need insurance more than ever.

Ask yourself the following questions:

- What kind of items am I shipping (Fragile or high-value)?

- How often do I experience lost or damaged shipments (Frequency of issues)?

Understanding these factors will help you choose an insurance provider that offers the right level of protection based on the risks you face.

2. Compare Shipping Insurance Options (Carrier-Provided vs Third-Party)

Many e-commerce businesses rely on carrier-provided insurance, which can be convenient but may not always offer the best value or coverage. To put it into comparison:

Carrier-Provided Insurance: Shipping carriers like UPS, FedEx, and USPS often offer insurance as part of their shipping services. While this is convenient, the coverage limits can be restrictive.

Third-Party Shipping Insurance: A third-party insurance provider offers more flexibility and often provides broader coverage options than those offered by carrier-provided insurance. They are also usually more cost-effective for businesses with high shipment volumes.

3. Determine Coverage Options

Not all shipping insurance policies are equal. Different providers offer varying levels of coverage depending on the type of goods, shipment destinations, and the specific needs of your business.

Here are some factors to consider:

- Comprehensive Coverage: Protects against a wide range of risks, including loss, damage, and theft.

- Maximum Coverage Limit: Sufficient coverage for your most valuable items

- Exclusions: Specific items or scenarios that the insurance won’t cover, such as high-risk international shipments, perishable goods, partial coverage (loss but not damage or certain shipping methods), etc

- International Coverage: Ensure your provider covers international shipments if you sell globally.

Make sure you choose insurance that aligns with your shipping habits and the level of protection you require. If your products are high-value or shipped to locations with higher risk, you’ll want more comprehensive coverage. Choose an insurance provider that offers flexibility in coverage limits, allowing you to adjust based on the value of each shipment.

4. Consider Rule-Based Shipping Insurance

One of the latest innovations in shipping insurance is rule-based insurance, which allows e-commerce businesses to automatically apply insurance based on specific conditions.

For example, you can set pre-set rules to:

- Automatically ensure orders above a certain value.

- Set insurance rules for fragile or high-risk items.

- Customize policies based on customer location or shipping methods.

This flexibility saves time and ensures that you’re only paying for insurance when necessary, avoiding the cost of insuring low-risk shipments while fully protecting high-value orders.

5. Evaluate the claims process

A key aspect of shipping insurance is how easy and fast it is to file and resolve claims. When evaluating shipping insurance providers, pay close attention to the following:

Claims Filing Process: Is the process straightforward, or does it involve complicated paperwork?

Claims Resolution Time: How long does processing and approving claims take?

Filing claims manually can be time-consuming and often results in delays in receiving reimbursement.

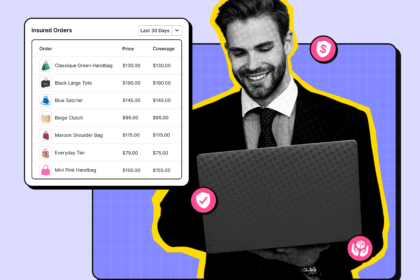

When choosing a shipping insurance provider, look for those that offer automated claims management. With LateShipment.com, all things insurance happen inside a unified portal, giving you access to a centralized view of submitting claims, tracking statuses, and everything else, thereby helping you save time and improve accountability.

How Much Does Shipping Insurance Cost?

The cost of shipping insurance isn’t a fixed number. It varies based on several factors. However, the general rule is that the riskier your shipment, the more it will cost. Here’s a breakdown of what can affect the costs:

Declared Value: Insurance costs are usually calculated as a per cent of the declared value of your shipment. The higher the value you declare, the higher the insurance premium. However, it’s important to declare the actual value. Under-declaring can lead to problems if you need to file a claim. You won’t be reimbursed for the full value of your goods.

Type of Goods: Some items are inherently riskier to ship than others. Fragile items like glassware or ceramics, easily damaged electronics, and high-value goods like jewelry or artwork will generally have higher insurance rates. Insurers consider the likelihood of damage or loss when setting premiums.

Destination: Where you’re shipping matters. Shipping to specific destinations can be more expensive to insure due to factors like political instability, high rates of theft or package pilferage, challenging shipping conditions, or even natural disaster risks.

Shipping Method: The method you choose (ground, air, sea) also plays a role in costs. Air freight is often faster and generally considered less risky than sea freight, which can influence insurance costs. However, each method has its own set of potential risks.

Coverage Type: The type of coverage you select (all-risk vs. named perils, for example) will affect the cost. All-risk insurance usually covers a broader range of potential problems and will typically be more expensive than named perils insurance, which only covers specific incidents.

Final Thoughts

The correct shipping insurance can help you protect your revenue, maintain customer satisfaction, and reduce stress. However, when you’re shipping hundreds of packages, selecting the right insurance protection for each one can be tedious and time-consuming. The solution would be to automate the process.

This is where LateShipment.com comes in. With a high claim success rate and fully automated claims management, LateShipment.com’s Shipping Protection and Insurance software offers a convenient and quick solution. LateShipment.com allows you to apply the right insurance to every shipment, choosing from comprehensive coverage options.

The intelligent insurance automation features make it easy to set custom rules, add insurance on-demand, and ensure every package is protected. We all know insurance claims can be a pain. LateShipment.com also takes care of this, fully automating the claims process with a centralized portal for effortless handling.

Want to benefit from these features? Book a demo and try LateShipment.com’s Shipping Protection and Insurance Software today.

Related Readings

FAQs about Fedex Refund

Is shipping insurance worth it?

The value of shipping insurance depends on the value of your shipment and your risk tolerance. Despite proper packaging techniques and precautionary measures, there is a chance that packages will get lost or damaged while in transit. For high-value or fragile items, it’s often worth the investment.

Can I get shipping insurance from my shipping carrier?

Yes, many shipping carriers offer insurance options. However, it’s wise to compare prices and coverage with third-party providers, who might provide better coverage options and claim processes, have better customer reviews, etc.

How do I choose a shipping insurance provider?

Weigh the pros and cons of carrier insurance, third-party, and self-insurance, and understand what’s usually covered and how you can get the best out of it. Here’s a guide that covers all the information you need to choose a shipping insurance provider.