Imagine you’ve just shipped a large consignment of handcrafted merchandise to a retail partner across the country. It’s time-sensitive, high-value, and meant to hit shelves before a weekend sale. A week later, you get a call. It never arrived. Worse, the tracking status hasn’t been updated in days.

This isn’t just inconvenient. It puts your relationship, revenue, and reputation at risk. Whether it’s lost in transit or arrives damaged, you’re left scrambling to refund, replace, or explain.

That’s exactly why Canada Post shipping insurance exists. It’s your safety net when things don’t go as planned, and when you ship often, that safety net matters more than you think.

In this article, we explore how Canada Post shipping insurance works and how you can file successful claims every time with the help of automation.

What is Canada Post Shipping Insurance?

Shipping insurance protects the declared value of a package if it’s lost, stolen, or damaged during transit. It acts as a financial buffer, so you’re not absorbing the full cost when things go wrong.

For businesses that ship regularly, this is a smart way to protect your margins. Whether you’re sending high-value products, fragile items, or time-sensitive orders, having coverage in place means you’re prepared for the unexpected.

Types of Canada Post Shipping Insurance Offered

Canada Post’s insurance offerings are tied to the service level you choose and the declared value of your shipment. Here’s a breakdown of what’s covered and what you can add:

1. Included Liability Coverage (Up to $100)

Most premium services include basic insurance at no extra cost:

- Priority™, Xpresspost™, Expedited Parcel™ : $100 included

- Flat Rate Box: $100 included (no additional coverage available)

- Tracked Packet™ USA/International: $100 included

2. Optional Additional Coverage (Up to $5,000)

You can purchase additional coverage in increments of $100:

- Up to $5,000 is available for domestic shipments

- Up to $1,000 for U.S. and international packages

- Requires purchasing the Signature option for amounts over $200

3. No Default Coverage (Must Buy Initial $100)

- Regular Parcel™, Xpresspost™ Certified, Small Packet™ USA/Intl.

- These services offer no included liability. You must pay for coverage from dollar one.

4. Limitations for High-Risk Items

Certain goods like jewelry, precious stones, coins, and gift cards have maximum coverage limits (as low as $100–$500). Fragile items and electronics must be properly packaged, or they won’t be covered at all.

Benefits of Using Canada Post Shipping Insurance

Canada Post shipping insurance helps businesses reduce financial risk and improve customer experience. It’s especially helpful when shipping fragile, expensive, or time-sensitive items. Some benefits include:

- Compensates for lost or damaged shipments: When something goes wrong in transit, insurance lets you recover the value of the item and postage.

- Protects high-value and fragile goods: Items that are more likely to be lost or damaged can be insured for up to $5,000 with the right service.

- Enables faster customer service resolution: With coverage in place, you can send replacements or offer refunds without hesitation, keeping customer satisfaction high.

- Offers flexible coverage options: You choose which shipments to insure and how much coverage to apply based on order value, product type, or destination.

Claims Process for Shipping Insurance

Canada Post allows insured senders to file a claim if a shipment is lost or damaged. The process involves verifying coverage, gathering details, and submitting the claim within the specified timeline.

Step 1: Check eligibility

Confirm that the service used includes insurance or that you purchased additional coverage. Only the sender is eligible to file a claim.

Step 2: Gather the required information

You’ll need the tracking number, package value, sender and recipient details, and a description of the contents. Supporting documents may be requested.

Step 3: Submit the claim

Use Canada Post’s support ticket system or call their helpdesk for high-value claims. Include all relevant shipment details and documentation.

Step 4: Wait for review

Canada Post investigates the claim. You’ll be contacted if more information is needed, and most domestic claims are resolved within 10 business days.

Step 5: Receive compensation

If approved, you’ll receive a refund for the insured value and postage via the original payment method or by cheque.

Common Misconceptions About Shipping Insurance

Shipping insurance sounds simple, but there are a few common misunderstandings that can leave businesses surprised when claims are denied.

1. Declared value equals the guaranteed payout

Many assume that declaring an item’s value means they’ll automatically get that amount back if something goes wrong. In reality, Canada Post pays out the lesser of the declared value, the item’s actual value, or the maximum allowed for that item. If your declared value is $500, but the item is worth $300, you’ll only get $300.

2. All items are covered by default

Just because you have insured a shipment doesn’t mean everything inside is automatically protected. Items like glassware, electronics, or perishable goods are often excluded unless packaged according to specific guidelines. If your packaging doesn’t meet those standards, your claim could be denied.

3. You can file a claim anytime

There are strict deadlines for filing claims. For damaged items, you may have as little as 21 days from delivery. For lost packages, you must file within 9 months of the shipping date. Waiting too long can mean forfeiting your refund entirely.

Tips for Maximizing Canada Post Shipping Insurance

To get the most out of Canada Post shipping insurance, you need a few smart habits that can help you avoid claim rejections and recover costs faster.

1. Double-check service levels and coverage limits

Not all services include insurance, and not all offer the same limits. Make sure you understand which services provide default coverage and when you’ll need to purchase additional liability protection.

2. Use proper packaging, especially for fragile items

Even if your package is insured, a claim may be denied if the item wasn’t packed properly. Follow Canada Post’s packaging guidelines to avoid issues with claims involving breakage.

3. Keep records of each shipment

Save tracking numbers, receipts, photos, and proof of value for all insured items. This documentation can speed up the claims process and make approvals more likely.

4. Automate your insurance and claims process

If you’re shipping at scale, use shipping insurance software to apply rules, automate coverage, and trigger claims instantly. This reduces errors, saves time, and ensures you don’t miss claim deadlines.

Real-Life Examples of Shipping Insurance in Action

Shipping insurance becomes truly valuable when the unexpected happens. Here’s an example of how it may work out in real life. Imagine a Toronto-based business that sends a $1,200 custom lighting fixture to a client in Calgary using Xpresspost™ with added insurance. The shipment is marked as delivered, but the client never received it.

After submitting a claim with proof of value and tracking, the business recovers the full amount and quickly resends the order without taking a financial hit. This is how Canada Post shipping insurance can work in your favor.

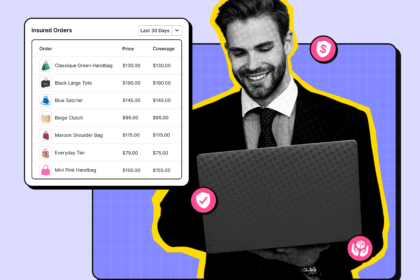

Protect Shipments at Scale with LateShipment.com

Canada Post’s shipping insurance is a smart move, but managing it manually, especially at scale, can be overwhelming. If you’re shipping hundreds of parcels a month, you need a faster, smarter way to stay protected.

That’s where LateShipment.com’s Shipping Protection and Insurance Software comes in.

We automate everything, from adding insurance coverage during fulfillment to handling claims when packages are lost or damaged. You set the rules, and our system does the rest.

You also get access to intelligent claim trends and insurance analytics to help you fine-tune your risk strategy. Whether it’s automating coverage based on order value or identifying weak links in your delivery chain, LateShipment.com gives you the tools to protect revenue and reputation at scale.

Book a free demo today and see how stress-free shipping insurance can really be.

Related Reading

FAQs about Canada Post Shipping Insurance

What is Canada Post shipping insurance, and how does it work?

Canada Post shipping insurance covers the declared value of your package if it’s lost or damaged in transit. Coverage depends on the service used and whether additional insurance was purchased. If eligible, the sender can file a claim and receive compensation after a review.

Does Canada Post automatically insure packages, or do I need to buy additional coverage?

Some services, like Xpresspost™ and Priority™, include up to $100 in liability coverage. Others, like Regular Parcel™, offer no default coverage. If your package exceeds that value or uses a basic service, you’ll need to buy additional coverage during shipping.

How much does Canada Post shipping insurance cost?

Insurance costs vary depending on the declared value and service level. Additional coverage is typically purchased in $100 increments, up to a maximum limit. Charges also depend on the shipping destination and may require a signature for coverage over $200.

What is the maximum insurance coverage available with Canada Post?

For most domestic services, Canada Post offers up to $5,000 in insurance coverage. U.S. and international shipments are generally limited to $1,000. Certain items, like jewelry or gift cards, have lower maximums regardless of declared value.

Is Canada Post insurance worth it for valuable items?

Yes. For high-value, fragile, or time-sensitive items, insurance offers financial protection if something goes wrong. It helps you recover losses and resolve customer issues faster, which is especially useful if you ship frequently or at scale.