Purolator is one of Canada’s most trusted shipping carriers. With a wide range of express, ground, and international delivery services, it supports businesses of all sizes in moving packages across the country and beyond. From documents and e-commerce orders to industrial shipments, Purolator handles millions of packages each year.

Still, even experienced carriers can run into issues. Packages get damaged. Shipments go missing. Weather, transit delays, and handling errors create risks. That’s where shipping insurance steps in. It protects your business from financial loss when a shipment doesn’t reach the customer as expected.

If you rely on Purolator for your day-to-day shipping, understanding how their insurance works is your first step toward smarter shipping decisions. This article explains how Purolator shipping insurance works, how to purchase it, and how to file a claim if things go wrong.

Understanding Shipping Insurance

Shipping insurance covers the declared value of a shipment if it gets lost or damaged in transit. Without insurance, you may not recover the full cost of the item or any cost at all, depending on the carrier’s liability limits.

Insurance is especially helpful when shipping high-value items, fragile goods, or time-sensitive deliveries. For businesses, it offers peace of mind, protects margins, and helps maintain customer trust even when something goes wrong.

Purolator's Shipping Insurance Options

Purolator offers limited default coverage and the option to add full-value insurance at the time of shipping.

Default Coverage

If you don’t purchase additional coverage, Purolator provides basic protection by default:

- $2.00 CAD per pound or $4.41 CAD per kilogram, based on package weight

- This coverage only applies to lost or damaged shipments

- It does not cover late deliveries unless they fall under Purolator’s service guarantees

Declared Value and Additional Insurance

When creating a shipment, you can enter a declared value of up to $5,000 CAD.

- Insurance applies only if the declared value exceeds $100

- An insurance surcharge is added for the extra coverage

- You’ll need supporting documents (invoices, proof of value) in case of a claim

Note: Declared value does not increase Purolator’s liability for non-insurable items or prohibited contents.

Benefits of Using Purolator's Shipping Insurance

Shipping insurance keeps your business safe from financial loss when packages are damaged or lost during delivery. Purolator’s insurance options offer flexible coverage, faster resolution, and peace of mind, especially for high-value or time-sensitive shipments.

1. Recover Full Shipment Value

Purolator’s standard liability only covers $2.00 CAD per pound. If you’re shipping valuable products, this isn’t enough. Declared value insurance allows you to recover up to $5,000 CAD, provided your packaging is compliant and you submit proper documentation.

2. Protect Fragile or High-Risk Shipments

Breakable or high-risk items like electronics, industrial parts, or luxury goods require an extra layer of protection. When packed correctly and insured, these shipments qualify for claims if they’re damaged during transit.

3. Reduce Out-of-Pocket Refunds

Without insurance, you’ll need to cover replacement costs yourself if something goes wrong. Insurance shifts this risk back to the carrier, saving you from refunding customers or re-sending orders at your expense.

4. Maintain Customer Confidence

Lost or damaged orders can impact customer loyalty. Insurance speeds up resolution timelines and helps you provide replacements or refunds faster, without waiting on extended internal reviews.

5. Simplified Claims Process

When insured, your shipments are eligible for a more structured claims review process. Purolator assigns a case number, confirms the issue, and releases compensation once documentation checks out.

How to Purchase Shipping Insurance with Purolator

You can add insurance during the shipment setup process through Purolator’s shipping tools.

Here’s how:

Enter Shipment Details

Provide a description of the item, package type, weight, and number of pieces, and select a Purolator service.

Add Declared Value

In the “Declared Value” field, enter the total value of the shipment. This triggers the insurance surcharge for coverage above $100.

Review Packaging Requirements

Ensure the packaging meets Purolator’s standards. Poor packaging can void coverage.

Choose Additional Shipment Options

For higher-risk or sensitive items, use options like “Residential Signature Required” or “Additional Handling.”

Claims Process for Shipping Insurance

So, what should you do if your Purolator shipment is damaged or lost? Here’s a quick breakdown of the claims process for insured shipments:

Learn more: How to File Purolator Damage Claims?

1. Identify the Issue

If the shipment is damaged, submit a claim within:

- 60 days of delivery (for visible damage)

- 21 days of delivery (for concealed damage)

If the shipment is lost, initiate a trace. Once confirmed as lost, file the claim within 9 months of the shipping date.

2. Gather Required Details

You’ll need:

- Tracking number

- Shipment date

- Declared value

- Photos of damage (if applicable)

- Packaging materials used

- Claimant contact information

3. Submit the Claim

Use Purolator’s online Claim Submission Form

Claims over $500 CAD must be accompanied by phone support.

4. Retain Damaged Items

Keep all packaging and contents until the claim is resolved. Purolator may request an inspection.

5. Wait for Resolution

Claims are reviewed according to Purolator’s Terms and Conditions. Compensation is issued once the claim is approved.

Common Misconceptions about Shipping Insurance

Many businesses assume that declaring a shipment’s value guarantees a full refund if something goes wrong. That’s not always true. If the contents aren’t eligible, the packaging doesn’t meet Purolator’s standards, or the required documents are missing, your claim may still be denied, even with insurance.

Another common belief is that insurance covers delays. Purolator’s shipping insurance only applies to lost or damaged packages, not late deliveries. It also doesn’t cover restricted or prohibited items, so it’s important to review what’s excluded before shipping.

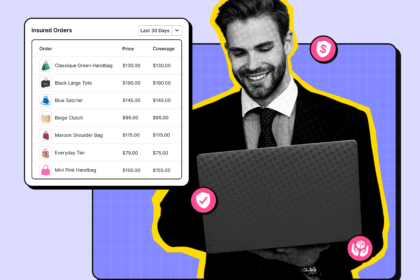

Automate Purolator Shipping Insurance Claims with LateShipment.com

Purolator’s shipping insurance offers real value when you’re moving high-value or time-sensitive goods. It helps protect your business from the financial hit of damaged or lost shipments. However, managing these claims manually, especially at scale, can drain your team’s time and lead to missed refunds.

That’s where LateShipment.com’s Purolator Refunds come in.

We automate the entire claims process for lost, damaged, and late shipments, not just for Purolator but for all major carriers. Our platform identifies every eligible refund opportunity, prepares and submits claims, tracks their status, and follows up without you lifting a finger.

We also offer automated shipping insurance tools, letting you add custom rules, apply coverage on demand, and track claims inside a unified dashboard. Whether you’re shipping 100 or 10,000 packages a month, LateShipment.com helps you cut costs and stay protected.